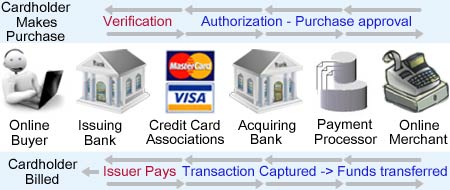

Credit card companies are well known for being the provider of electronic charge cards to millions. However, these companies are not the only business entity involved in the actual processing a credit card transaction. The process involves multiple players, including merchants, credit card processers, credit companies that provide the related lending, and eventually the cardholder’s bank.

The credit card transaction starts well before any purchase occurs. The first player in the process is the issuing bank that provides the credit card to an individual buyer in the first place. The card is issued and synced with the credit card company once an account number is designated to the individual. The issuing bank will also be the collector of debt when the account balance comes due.

The Purchase Itself

With the card the buyer goes to a merchant and makes a purchase. The merchant already has a merchant account established with another issuing bank synced with another credit card company, allowing the merchant to accept credit cards. As the buyer’s card is swiped, the data is transmitted via specialized equipment to an authorization network. This allows an exchange and validation with the issuing bank to make sure that there’s enough balance to charge against and that the purchase in question is allowed. This step allows an issuing bank to give an electronic green light or block the purchase before it occurs. When it gets blocked, the merchant receives a message that the card has been denied. If green-lighted, the transaction reads as “approved.”

The Payment

Once the transaction is approved or denied, the data is sent back to the merchant’s processing machine to be read. At the same time the transaction and related data are also recorded by the authorization system to create an archive for the cardholder, the merchant, and the issuing bank. When “approved” the merchant knows he can hand over the product bought by the customer. A receipt is produced as a paper record as well.

In the meantime, the issuing bank sends the necessary funds through an interchange system to the merchant’s account or acquiring bank to pay for the goods. The interchange system shaves off a small percentage from the merchant’s payment to pay for the service. Merchants who don’t want to eat this cost then mark up their prices slightly to make the customer pay for the processing fee.

Conclusion

Because the above processing occurs electronically, the system can usually handle thousands of transactions hourly and millions daily. This integrated approach allows millions of buyers to purchase services and product every day, moving money from their line of credit to merchants all over the nation and the world.